- Poverty Dead

- Posts

- Order Block Explained !!!

Order Block Explained !!!

Understand Order Blocks

Dear Traders

Order Blocks are a technical analysis concept used in trading. Michael J. Huddleston, often known as "The Inner Circle Trader," popularized this concept, which focuses on market dynamics and price changes.

An order block is a price range in which a considerable number of buying or selling happened, resulting in a noticeable price fluctuation. These blocks are pockets of liquidity where significant institutional players have placed orders. There are two kinds of order blocks: bullish and bearish.

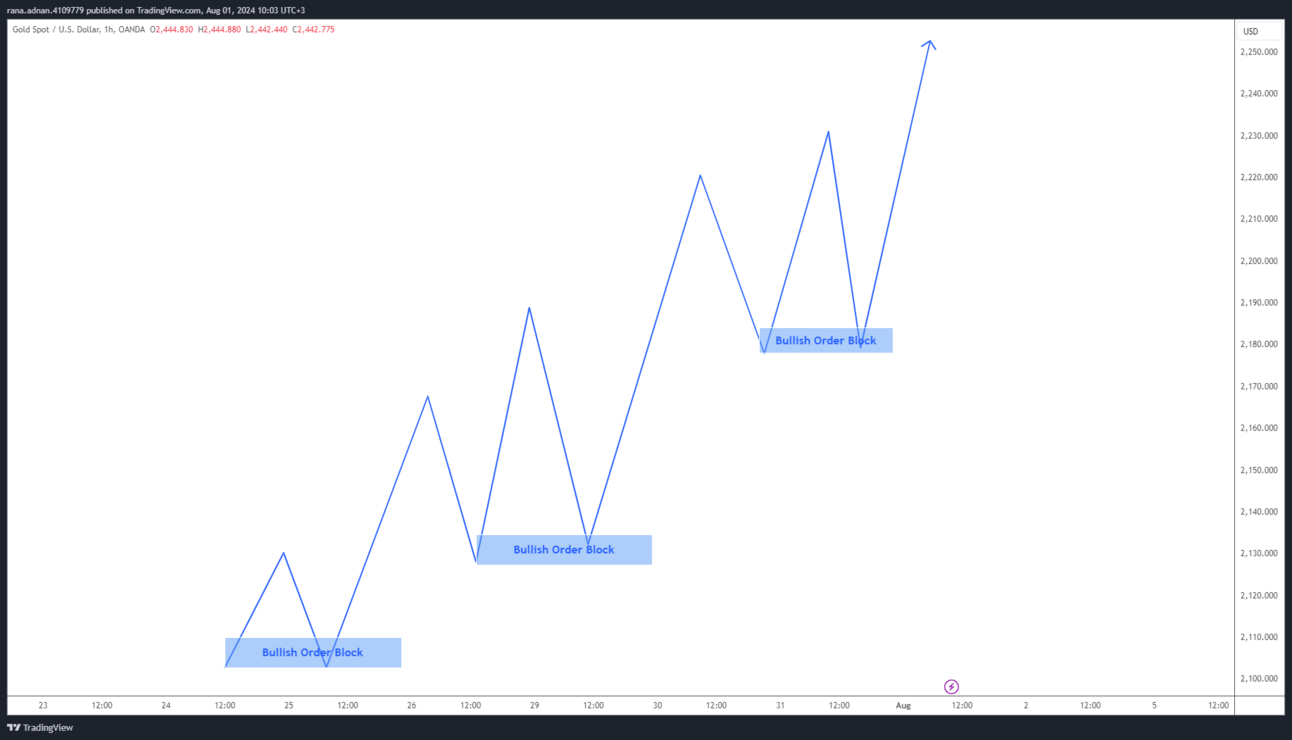

Bullish Order Block

This is a price range where a large volume of buying occurred. It usually forms during a decline before a sharp upward surge. A bullish order block indicates that institutional traders were building up long positions, leading the price to climb later.

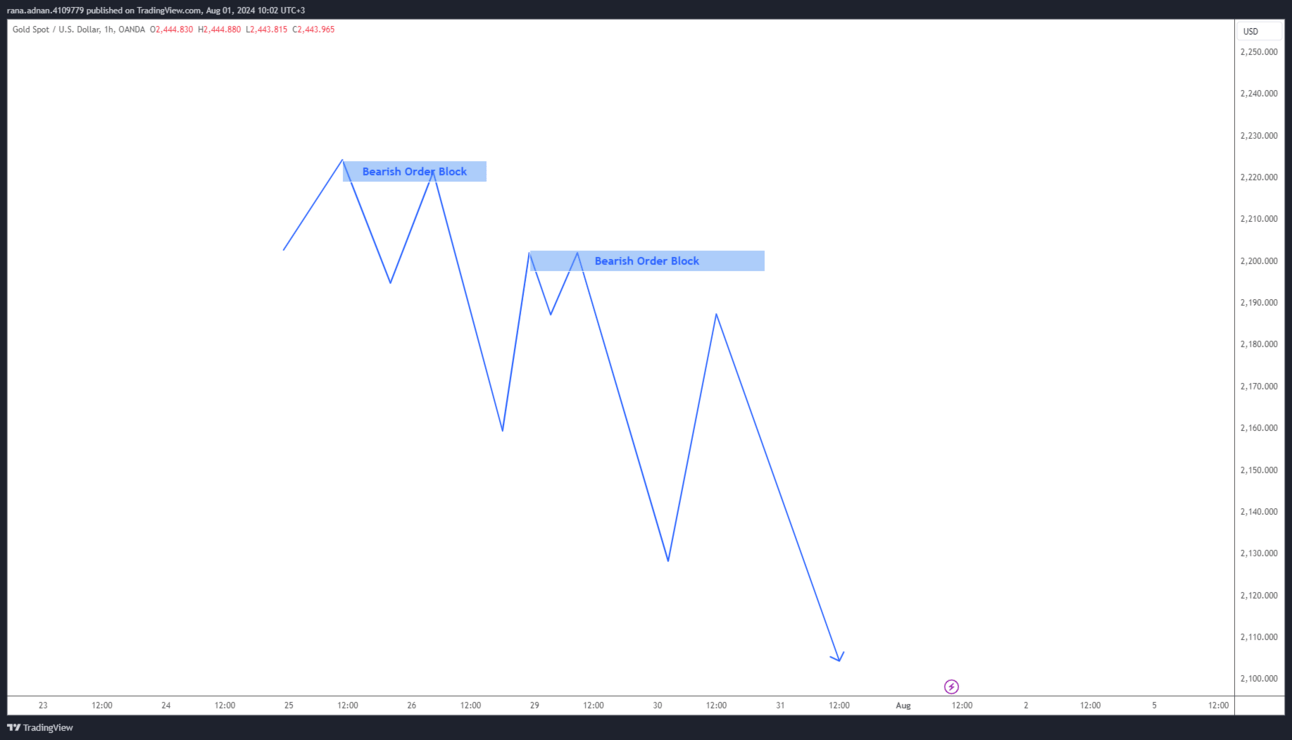

Bearish Order Block

This is a price range where a large quantity of selling has happened. It typically forms during an uptrend before a sharp downward fall. A bearish order block shows that institutional traders accumulated short positions, resulting in a price decline.

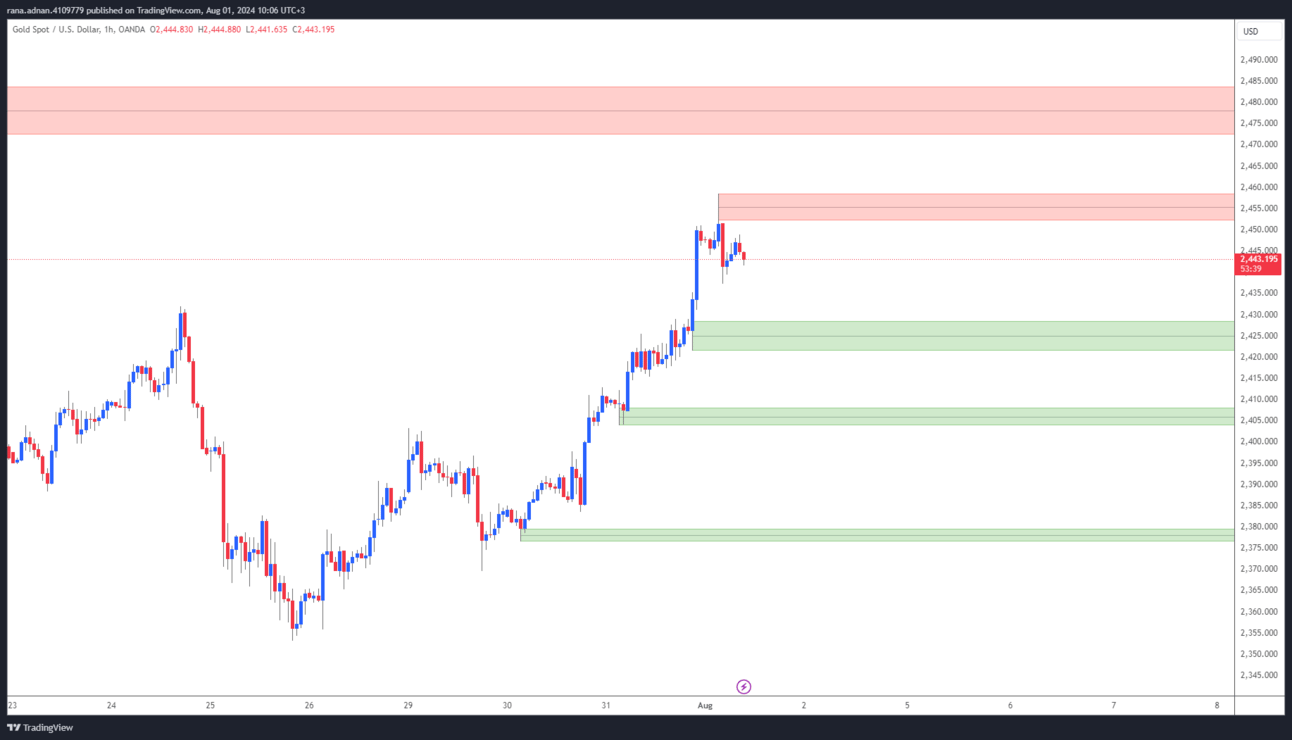

Traders employ order blocks to identify possible regions of support and resistance. When the price returns to these zones, it frequently reacts strongly due to the liquidity there. The notion highlights that institutions and significant market participants are not motivated to chase prices; rather, they prefer to wait for the price to return to these blocks in order to execute their trades at advantageous levels.

ICT Order Blocks are part of a larger strategy that combines other tools and concepts, including market structure, liquidity, and price action to help traders make informed decisions. Understanding and detecting these order blocks can help traders forecast future price fluctuations and devise more effective trading techniques.

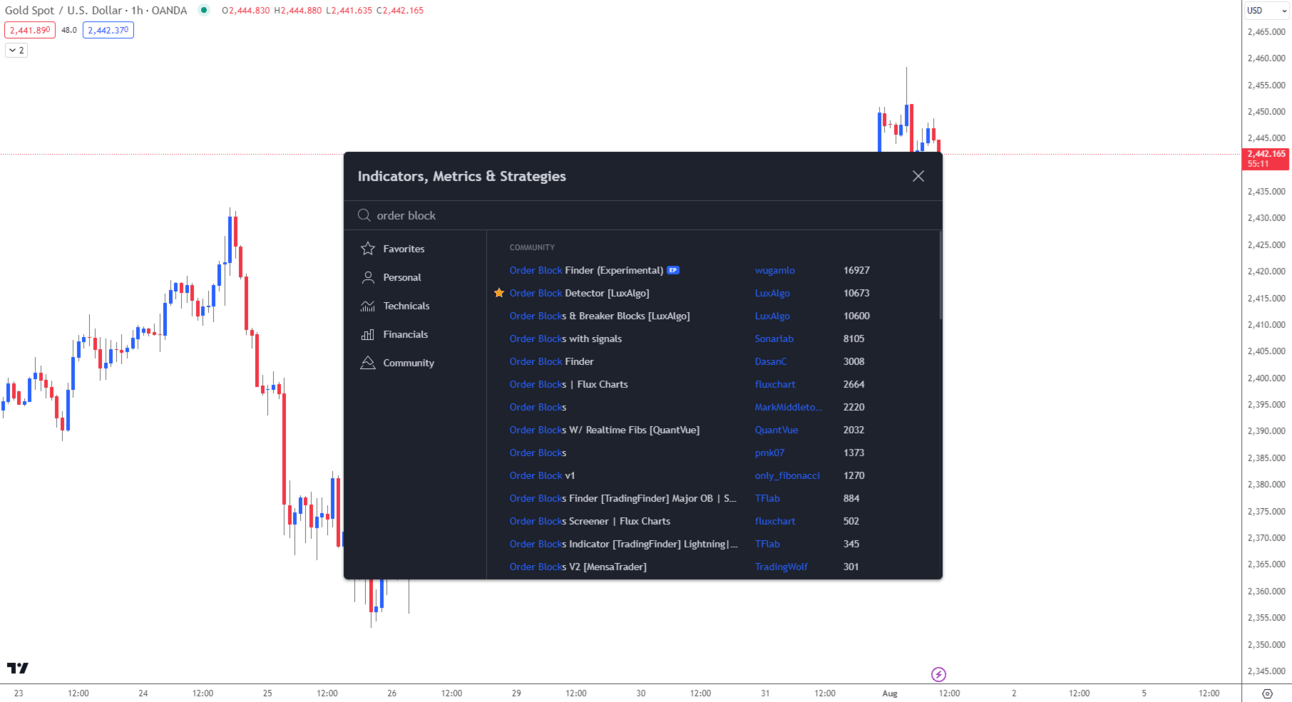

You can also add the "Order Block Detector" indicator on TradingView, and it will automatically mark bullish and bearish order blocks for you.

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

Happy Trading!!!

Poverty Dead